Kevin O’Leary On ERC

COVID-19 PANDEMIC – CARES ACT

March 27, 2020 the CARES ACT was signed into Law during the height of the Novel Corona-19 Virus Pandemic. Almost all Dental Practices as well as non-essential businesses closed down during this period. The CARES ACT implemented several stimulus programs to assist businesses, e.g. PPP Loans & ERC tax credits.

While many businesses were approved for PPP Loans, most businesses were denied ERC tax credits due to the rule’s lack of clarity for qualification creating massive confusion. The American Rescue Plan Act of 2021 modified and streamlined the ERC tax credit rulings extending the qualifications to receive grants for 2020 & 2021, but you must apply by April 15, 2024 for 2020, and you must apply by April 15, 2025 for 2021.

ERC stands for Employee Retention Credit for businesses who retained their W2 Employees during the 2020 & 2021 COVID Pandemic Period. Businesses that qualify, could receive up to $26k (10K avg) per W2 Employee, based on payroll periods in 2020 & 2021. If you had 10 Employees, that is a potential $260k maximum refund tax credit, it is a grant and not a loan, so it doesn’t need to be paid back!

Don’t delay, give your Dental or Medical Practice a “SHOT IN THE ARM” that it deserves to keep your business running strong and to recover from the disruption of the CORONA VIRUS, which still plagues us to this day!

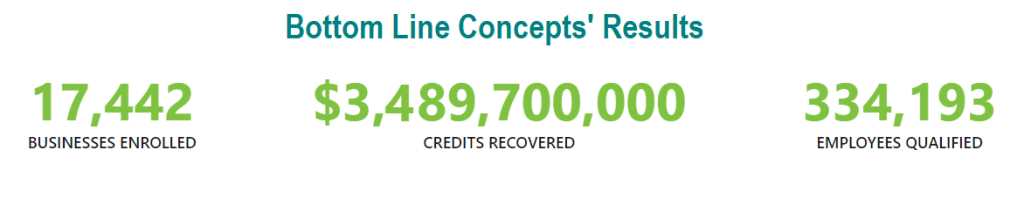

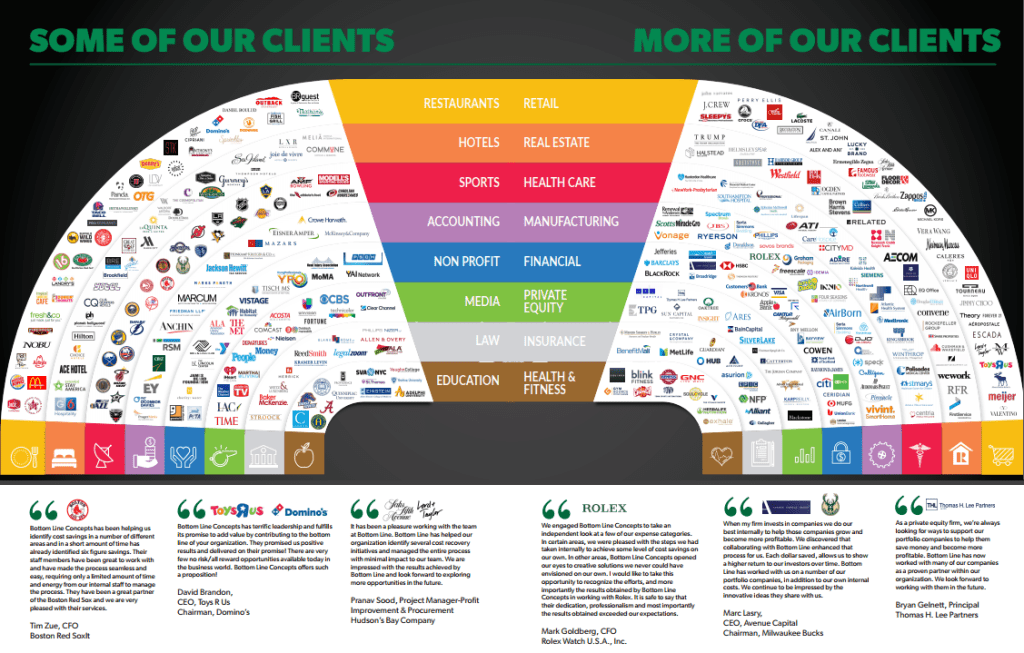

IRIS Services have Partnered with Bottom Line Concepts

About CARES ACT ERC Grant

Takes less than 10 minutes

No Upfront Costs to File

Why Bottom Line Concepts

The ERC underwent several changes and has many technical details, including how to determine qualified wages, which employees are eligible, and more. Your business’ specific case might require more intensive review and analysis. The program is complex and might leave your business accountant with many unanswered questions.

We can help make sense of it all. Our dedicated experts will guide you and outline the steps you need to take so you can maximize the claim for your business.